YvesBlue Custom ESG Scoring

Our Custom ESG Scoring tool allows users to control and align to their own ESG strategy. Create a customized view of ESG and impact scores based on what is important to you and your clients.

Why Choose Us

Build your own custom ESG weighting according to what is most important to your strategy

Easily and quickly re-score and re-weight the universe of securities and funds based on your values and utilize your own methodological approach to impact across one portfolio, multiple, or even the entire YB impact universe of over 50,000 global companies and 100,000 global mutual funds and ETFs.

Key Features

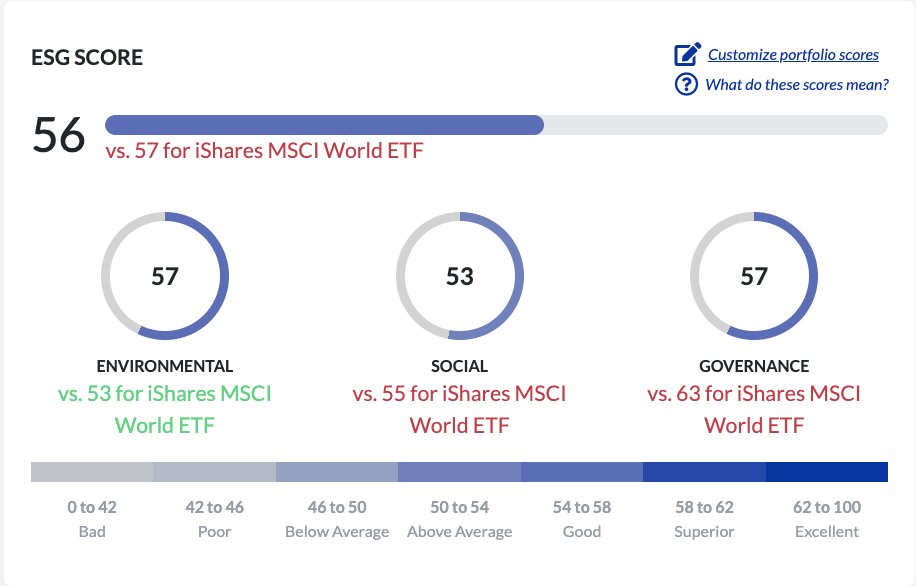

Flexible scoring at portfolio and company levels

- YvesBlue provides flexible ESG scoring prioritizing your organization or portfolio's ESG goals

- Build a proprietary scoring methodology and align directly with your own ESG investment strategy.

Key Features

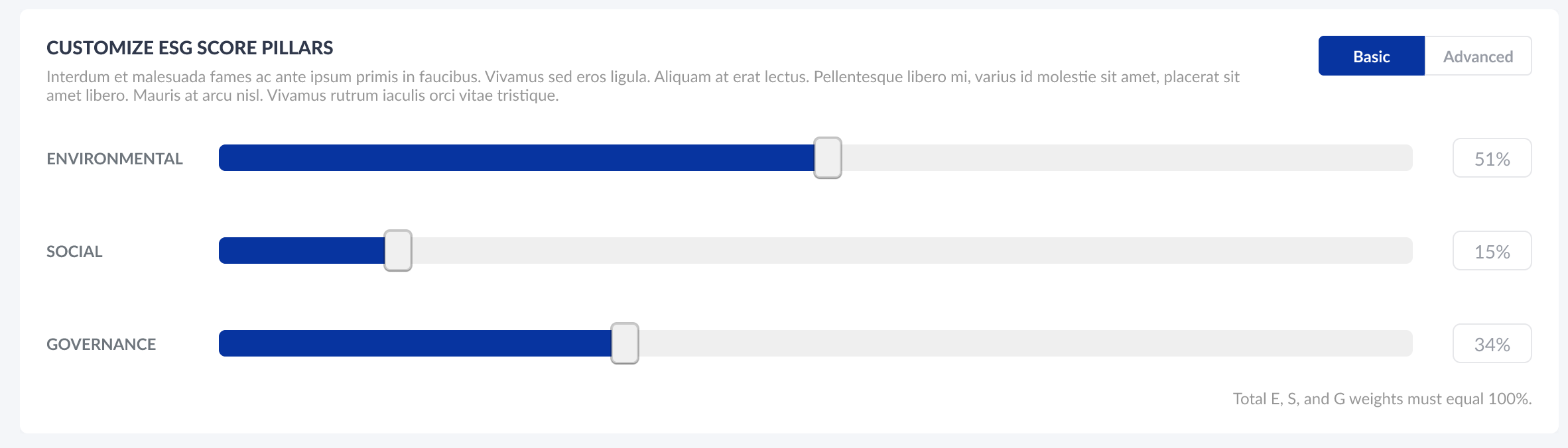

Custom ESG Pillar Weighting

- Set your own default weights across E, S and G pillars

- Tailor ESG scores and include in your specific forecast model

Key Features

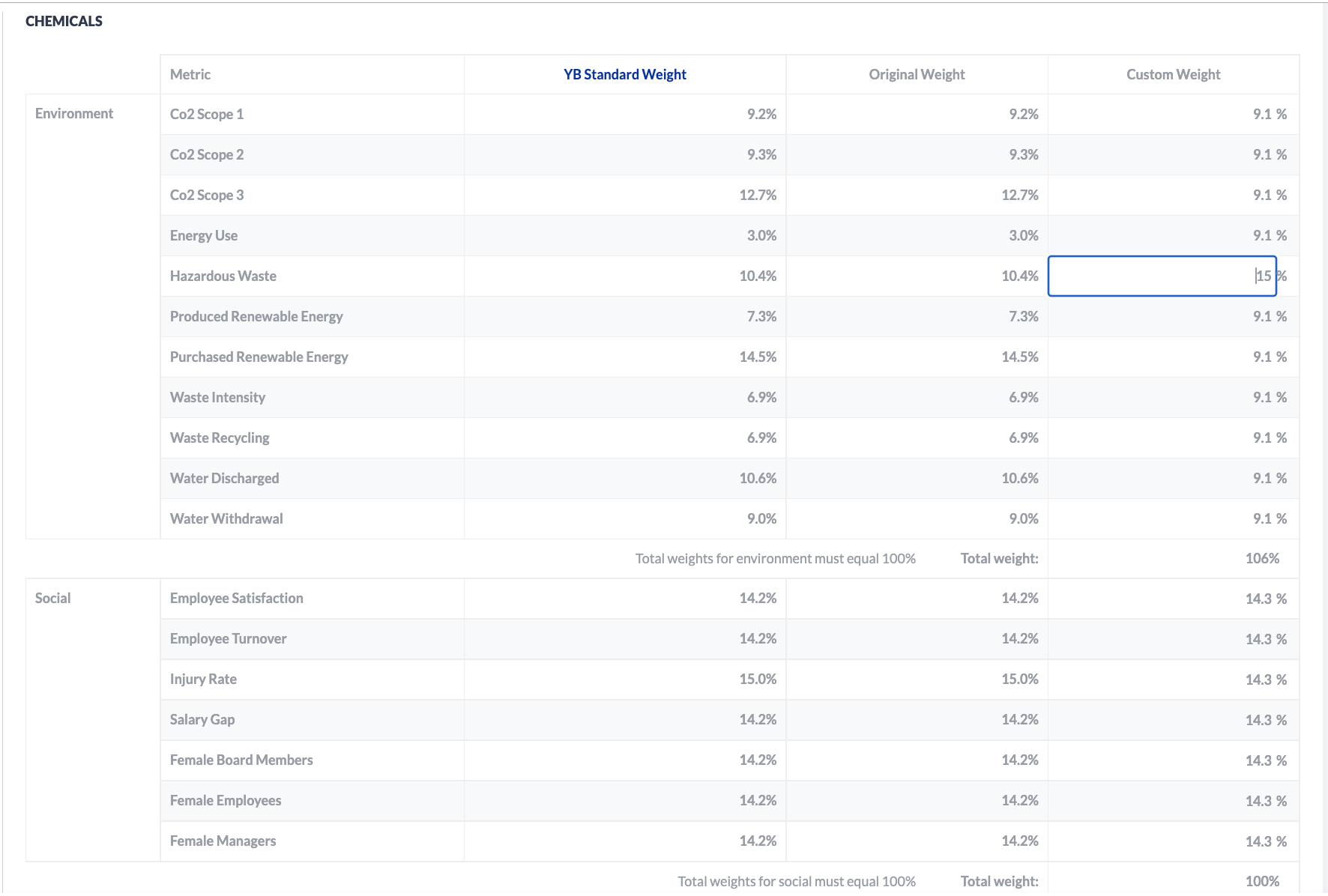

Sector and ESG Sub-Metric Weighting

-

Go deeper to customize weighting across specific sectors and across sub-metrics within E, S and G pillars

-

Easily make adjustments to the weightings and quickly perform research within the updated impact universe

Your strategy, your view

Impact investing by your definition. Weight and score the securities according to your values and investor goals.