YvesBlue Regulatory and Compliance

Our solution provides a simplified, more holistic and centralized approach to meet regulatory compliance including SFDR, PAI and manage risk through TCFD

Why Choose Us

Meet Regulatory Compliance with Confidence

ESG Regulation is rapidly approaching and comes with a multitude of challenges for managers including new reporting, governance and cost requirements. Muddying the path forward, standards and definitions on material ESG information differ by jurisdiction and governing body and still needs to be sorted out. With a growing number of ESG related regulations cutting across a variety of dimensions and geographies, how are you preparing?

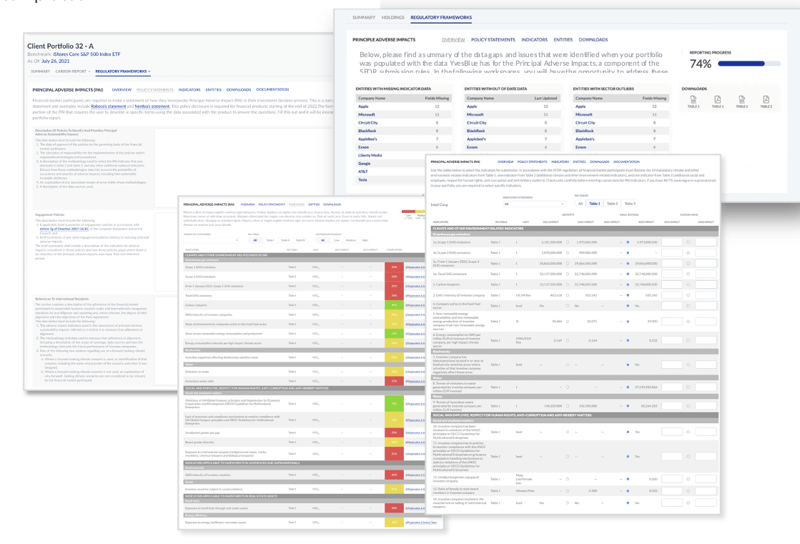

SFDR

- Build specific Article 8 & Article 9 universe by screening comprehensive indicator list and coverage dataset

- Entity and product level disclosure templates

- Easy templates for reporting to regulatory bodies through PDF or Excel

- Pre-populate the three key documents with YvesBlue data and customize as needed

- View reporting progress and completion rates

PAI Workflow

- Centralized platform to engage, capture necessary information and enter narrative disclosure statements

- Visualize and address data gaps; pre-populate data into required formats

- Prepare the dataset for use in Pre-Contractual Disclosure, Periodic Disclosure and Website Disclosure template

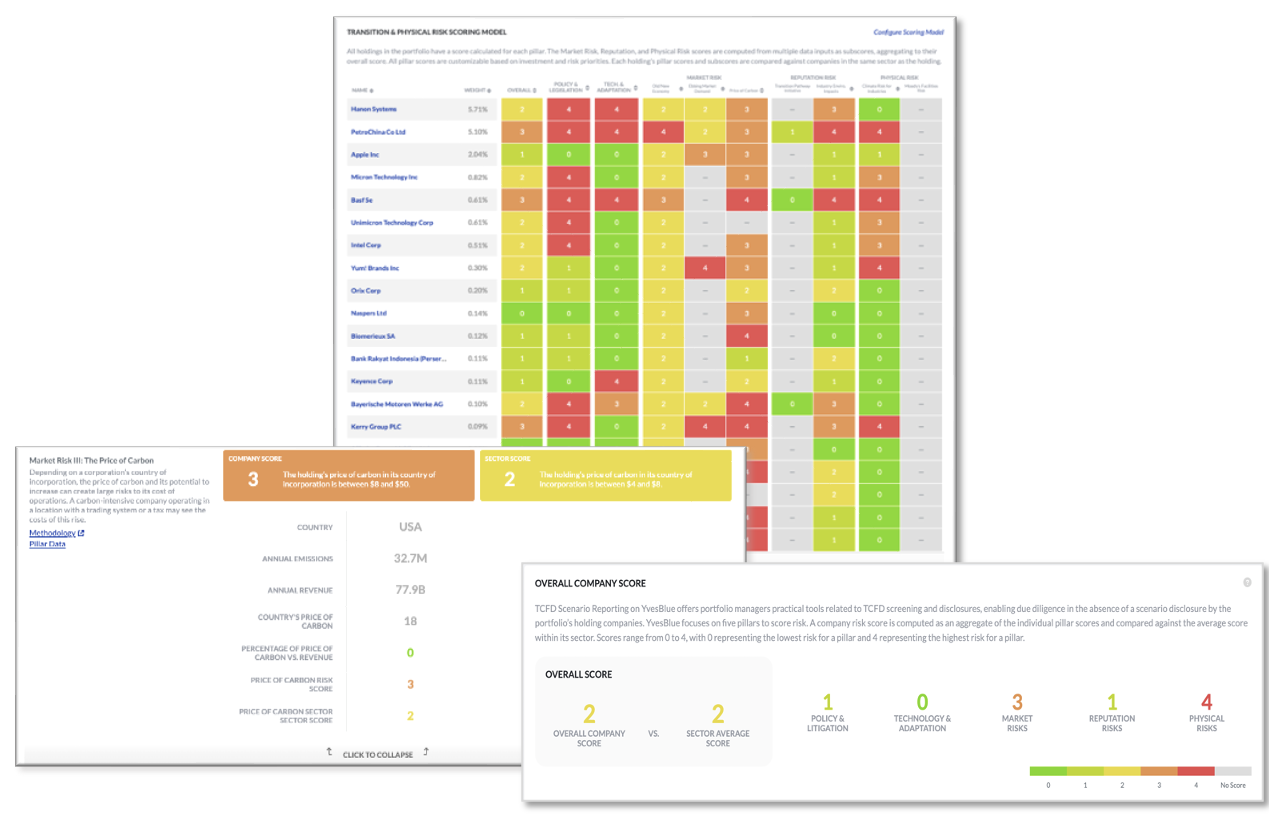

TCFD

Uncover opportunities and exposure to financial risks of climate change

- Screening and due diligence in absence of scenario disclosures

- Scenario risk scores on five pillars including Policy & Legislation, Technology and Adaptation, Market Risk, Reputation, & Physical Risk

- Further analysis on Price of Carbon, Transition Pathway Initiatives, Industry Environmental Impacts, Climate Risk for Industries

Simple. Central. Efficient

YvesBlue provides a centralized regulatory module that allows for company-wide synchronization of methodologies to manage risk, measure progress and disclose ESG related information.