YvesBlue Core Platform

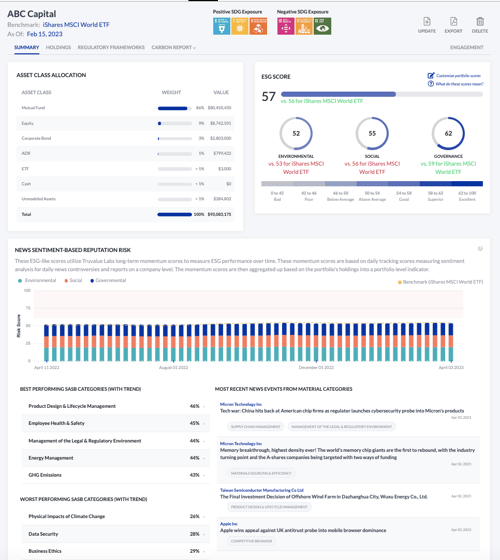

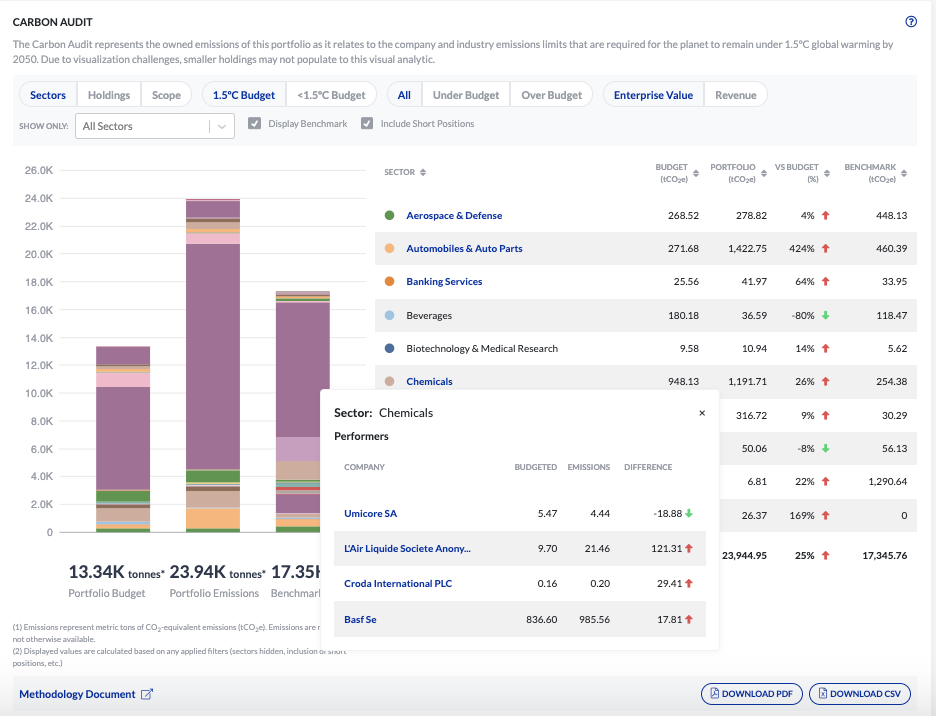

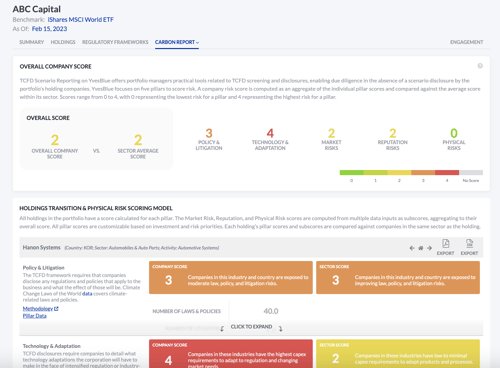

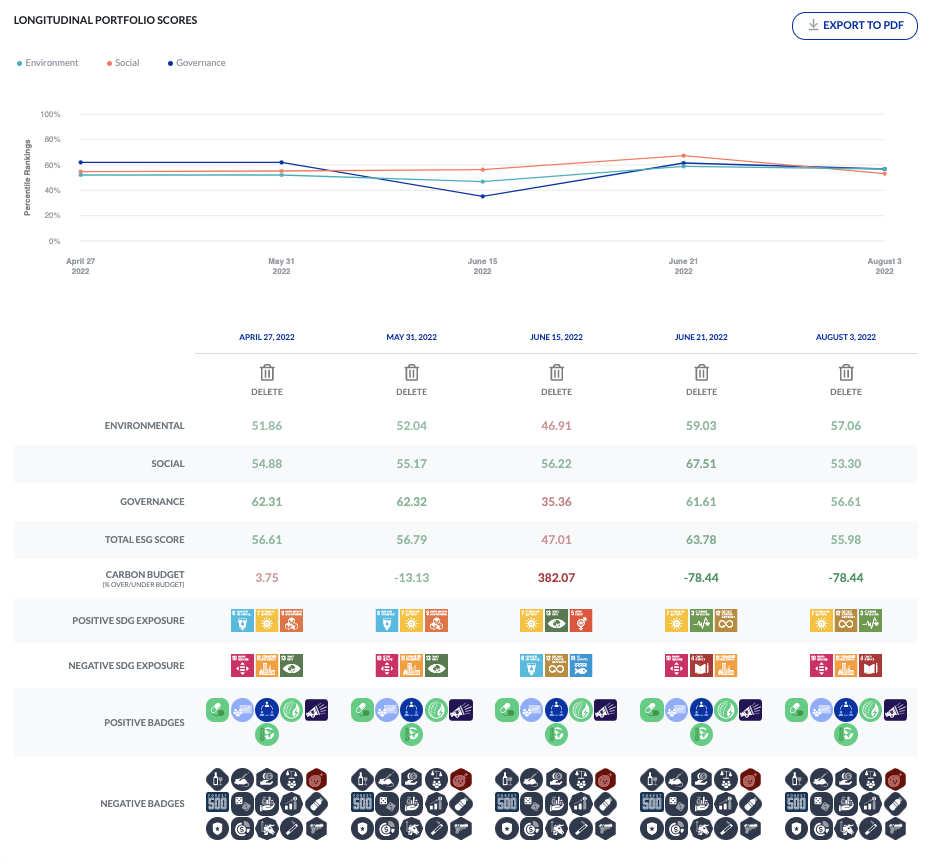

Our core suite of analytics empowers our clients to make better investment decisions. Our comprehensive platform includes advanced tools for research, portfolio construction, analysis at portfolio, fund and holding levels, risk management, peer analytics, and portfolio comparisons.

Make Better Decisions, Faster

Simplify the process of aggregating, reporting and making sense of the data. Our comprehensive suite of analytics and reporting tools along with transparency into the methodology allows users to more easily measure and manage their impact data and make better decisions.

Why Choose Us

Comprehensive Impact Reporting

- Turn data into actionable insight with our sophisticated reporting and analytics tools

- Aggregate disparate ESG data and simplify results through visual solutions

- Standardization, accuracy and key material insights and regulatory reporting fulfillment

- Streamline the due diligence process bringing efficiency to multiple layers of reporting

Why Choose Us

Sophisticated Analytics at All Levels

- Portfolio and Holding level analytics and custom competitive landscapes

- Deep dive into custom peer analytics across ESG scores, SDG alignments, and E, S and G factors

- Custom ESG scores with custom benchmarks and specific impact and ESG targets at organizational and portfolio levels

- Compare E, S and G scoring, carbon budget totals, framework alignment and impact assessment across different portfolios

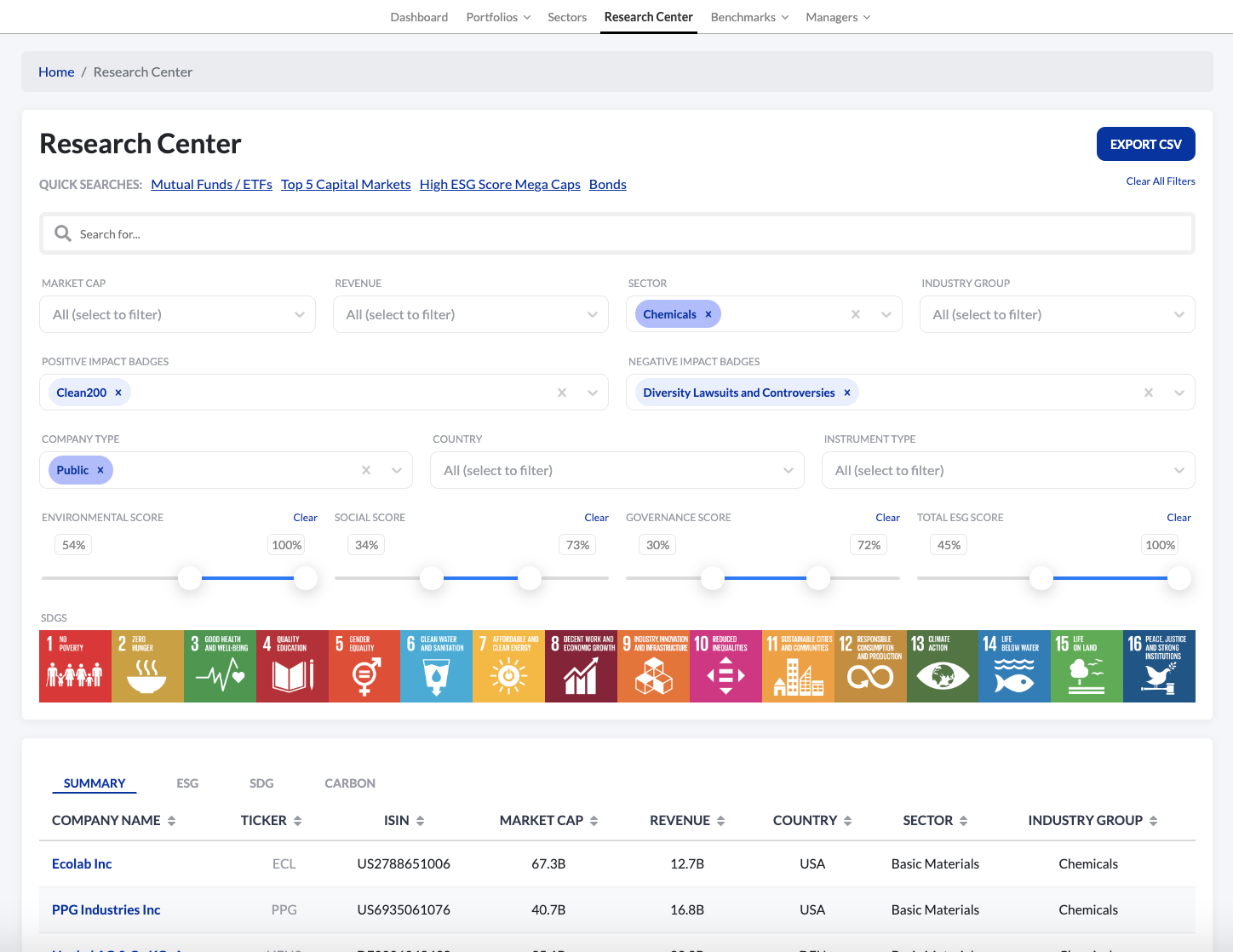

- Perform asset and fund screening by positive and negative badges, SDGs exposure

- Transparent data, customizable assessments in ESG, UN SDG alignment, carbon and SASB

Why Choose Us

Risk Management

- Portfolio and Holding level analytics and custom competitive landscapes

- Deep dive into custom peer analytics across ESG scores, SDG alignments, and E, S and G factors

- Custom ESG scores with custom benchmarks and specific impact and ESG targets at organizational and portfolio levels

- Compare E, S and G scoring, carbon budget totals, framework alignment and impact assessment across different portfolios

- Perform asset and fund screening by positive and negative badges, SDGs exposure

- Transparent data, customizable assessments in ESG, UN SDG alignment, carbon and SASB

Why Choose Us

Portfolio Construction and Comparison

- Portfolio and holding level analytics

- Live edit holdings, indices and investments to see impact over time and test impact effects

- Build custom competitive landscapes at the company level and portfolio level and view across ESG scores, E, S and G factors and UN SDG alignments

Why Choose Us

Deep Research

- Thematic and purpose-aligned screening

- ESG, SDG, Carbon and Summary results

- Leverage over 25+ data providers for access to over 55,000 companies and over 150,000 funds for multi-asset class ESG relevant information

YvesBlue provides all the tools you need to make better investment decisions