|

Oil & Gas: Impact & Investors Relevant Analytics

YvesBlue's Deep Dive Into Oil & Gas & YvesBlue Tools That Can Help

Oil prices are at record highs, even adjusting for inflation. This is both directly and indirectly harmful for low-income families. Ideally, we could rapidly transition away from fossil fuels but that isn’t happening. Products that require tracking a benchmark may not be able to avoid oil & gas holdings even if the prospectus promises to deliver low carbon investment.

Investors, whether returns-focused or impact-focused, may want to take note of the following issue areas:

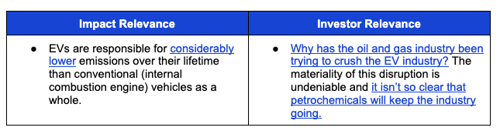

- Methane emissions

- Scope 3 emissions and reporting

- Expand capacity or invest in renewable energy and EV infrastructure

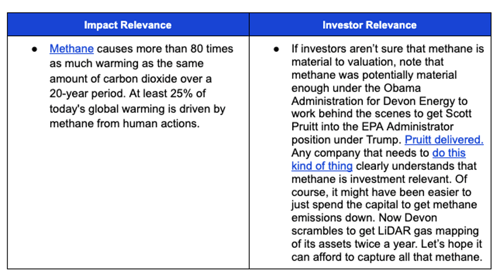

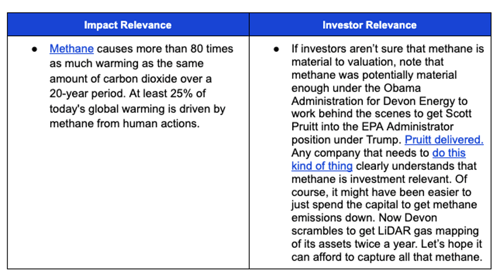

Methane Emissions

The production of oil and gas is resulting in much more methane emissions than was previously thought.

|

Read More

- Record Rise in Atmospheric Levels of Methane

- Close Ties Between EPA Head and Fossil Fuel Industry

- Pruitt's Collaboration With Oil & Gas Giant

|

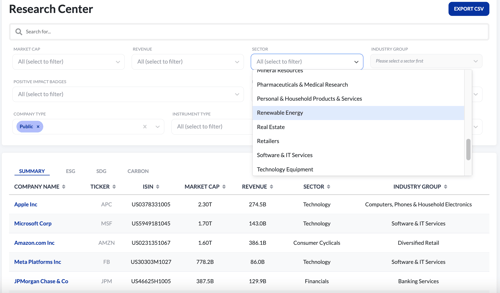

Relevant YvesBlue Tools To Help

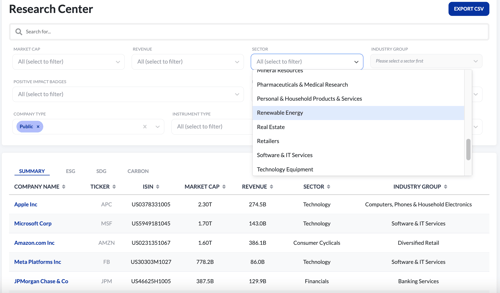

YvesBlue is always adding new data sets to the Research Center filter tool. Create your universe or watchlists by including or excluding factors. We’ll be adding the flaring data in the near future. Flaring is the process of burning excess natural gas at the production well using a dedicated flare to ignite the methane and other components in the gas, which can result in both methane and carbon dioxide emissions (CO2). Note that there are technologies that help companies stop flaring.

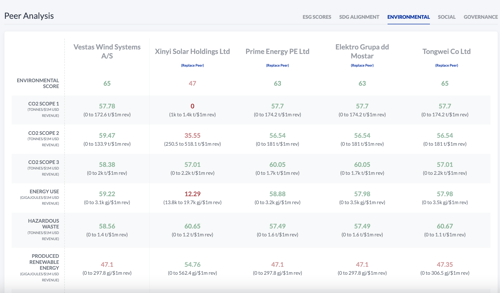

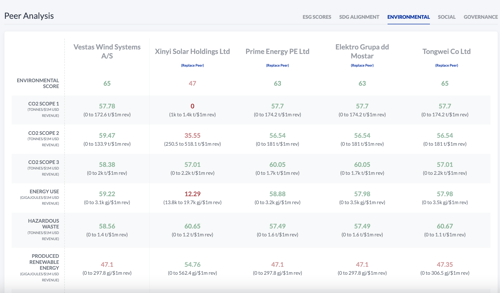

Additionally the Peer Analysis, shown below, allows users to custom compare different companies and see their competitive landscape across Scope 1, 2 and 3 emissions, ESG scores, SDG alignments and other ESG factors, with IdealRatings raw data points available.

|

|

|

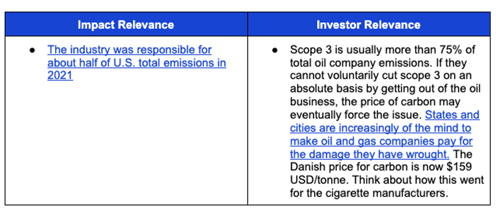

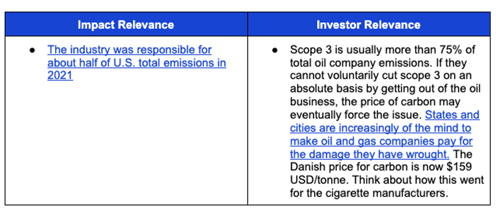

Scope 3 Emissions and Reporting

Scope 3 emissions come from upstream and downstream company activities. There are 15 subcategories of Scope 3 emissions for a company. Upstream this might be things like employee commute or business travel. Downstream end use of products. For the Oil & Gas industry, downstream is the main problem. A few of the biggest players have recently begun reporting scope 3 emissions albeit using intensity (a per unit of production basis) rather than on an absolute basis. This leaves a lot of room for shenanigans, especially now that the industry has discovered they can call their morally hazardous carbon capture activities an “offset”.

|

Read More

|

|

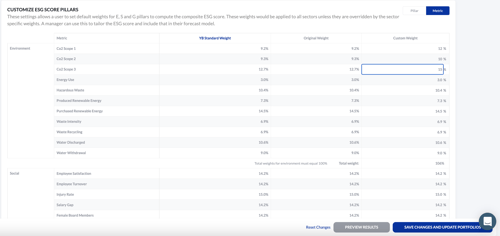

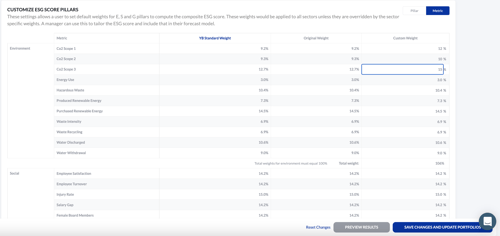

Relevant YvesBlue Tools To Help

Your portfolio weighting customization can emphasize Scope 3 emissions.

|

|

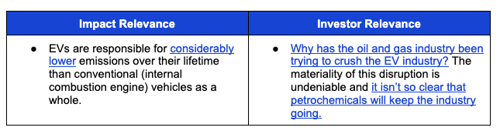

Expand Capacity or Invest in Renewable Energy and EV infrastructure

While the industry complains that it doesn't have the funds, that it will take too long, that they don’t have the permits, renewable energy projects are fairly quick to permit and install and they are far less expensive to build than creating new gas refining facilities. Renewable energy backed EV charging is the way forward. The Infrastructure Bill has $5B for EV charging infrastructure.

Read More

|

Relevant YvesBlue Tools To Help

YvesBlue has put together a list of solution providing companies that will be both in the research center and provided as a badge. Many of them are electric vehicles, renewable energy, and EV charging companies.

|

|

|

|

Tags:

sustainability,

tech,

carbon,

oil and gas,

ESG,

impact

Heather Langsner is Vice President and leads the Impact Team at YvesBlue. She is an experienced buy-side analyst and portfolio manager specializing in the Industrials, Chemicals, Technology, Energy and Renewables/Cleantech Sectors and holds a Master’s Degree in Environmental Sciences with a major in Industrial Engineering from Columbia University. In 2015, timed with the signing of the Paris Climate Accord, she launched the first net zero emissions equity portfolio called Carbon Zero for Groupe La Française in Paris. In 2017 she launched the Carbon Resiliency Technology Impact Fund which has an average outperformance of 14.6% per year since inception. She has been a technical and sustainability consultant for governments in the Middle East and for companies like Lenovo and Biogen. She studied Chemistry with a focus on Environmental Sciences at Johns Hopkins University and has been a speaker at the National Academy of Sciences, The American Chemicals Society and the United Nations Environment Program’s Conferences on Banking and Water. She serves as Vice Chair of the Center for the Economic and Environmental Partnership.