|

First Published May 17th, 2022 Chemicals - Impact & Investors Relevant Analytics

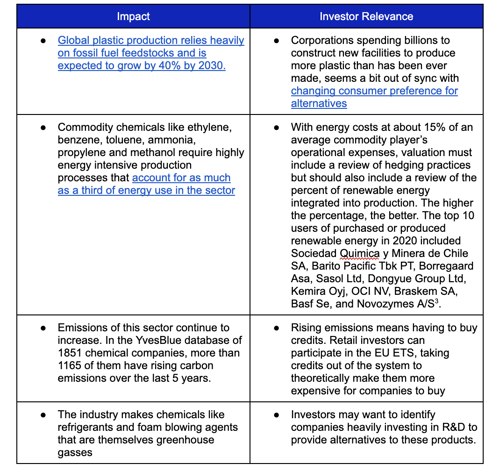

The Changing Landscape of the Chemical Sector Demand is shifting away from conventional fertilizers and plastics. As the input of many end products, the chemical industry can either be a partner in the shift to more sustainable production and products or become stagnant. Investors, whether returns-focused or impact-focused, may want to take note of the following issue areas:

Read More:

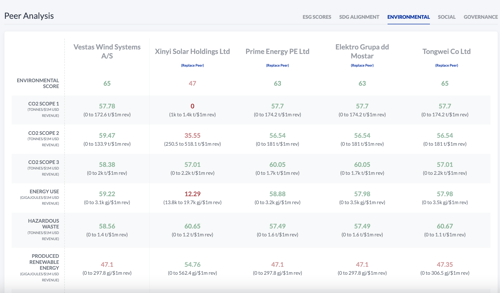

YvesBlue Tools to Help In YvesBlue, investors can navigate to the Peers Tool to compare companies on their environmental data:

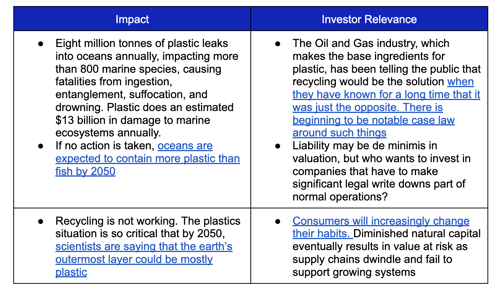

2. Circular Economy & Natural Capital Only in very specific civil engineering, construction and medical applications are plastics still entirely necessary. There was a time before plastics and while it has afforded great advances and convenience, most single use and non medical applications of plastics are not critical.

Read More

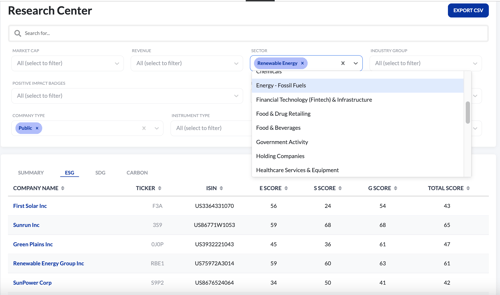

YvesBlue Tools to Help The YvesBlue Research Center is an increasingly detailed and sophisticated tool in the application that supports idea generation and helps investors set up downloadable alpha pools and focus lists. Here we can search for plastic pollution and identify companies that we want to engage with to help them improve or avoid as part of the portfolio construction process.

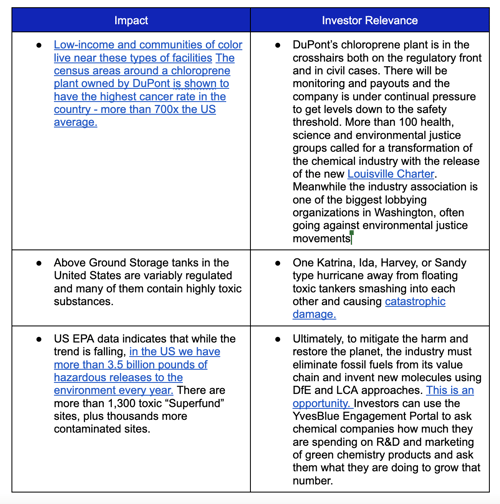

3. Environmental Justice & Fence-Line Communities

The 386-acre Shell plastic pellet plant (one of more than a dozen of this size going up around the world) with its own rail system and boasting a production capacity to deliver more than a million tonnes of plastic, is allowed by the state to emit 2.2 million tonnes of carbon dioxide each year.

According to the US EPA’s Toxic Release Inventory, ethane plants are responsible for an outsized impact on local communities.

Ethane crackers can emit pollutants such as nitrogen oxides, sulfur dioxide and particulate matter, as well as benzene, which is carcinogenic, and volatile organic compounds that can react with sunlight to form ground-level ozone. Plastic pellets escape rail cars and spill everywhere, getting into the food chain.

Read More:

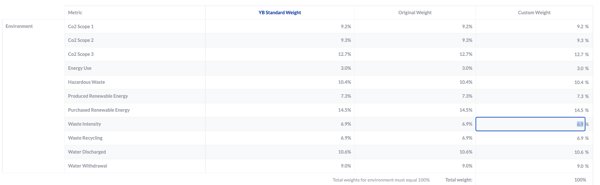

YvesBlue Tools to Help Hazardous waste is a data point we track in our ESG scores and if this issue matters to you, please use the pillar and metrics weights adjustment tool in YvesBlue.

|

Tags: sustainability, tech, carbon, oil and gas, ESG, impact, plastic, chemicals

Written by Heather Langsner

Heather Langsner is Vice President and leads the Impact Team at YvesBlue. She is an experienced buy-side analyst and portfolio manager specializing in the Industrials, Chemicals, Technology, Energy and Renewables/Cleantech Sectors and holds a Master’s Degree in Environmental Sciences with a major in Industrial Engineering from Columbia University. In 2015, timed with the signing of the Paris Climate Accord, she launched the first net zero emissions equity portfolio called Carbon Zero for Groupe La Française in Paris. In 2017 she launched the Carbon Resiliency Technology Impact Fund which has an average outperformance of 14.6% per year since inception. She has been a technical and sustainability consultant for governments in the Middle East and for companies like Lenovo and Biogen. She studied Chemistry with a focus on Environmental Sciences at Johns Hopkins University and has been a speaker at the National Academy of Sciences, The American Chemicals Society and the United Nations Environment Program’s Conferences on Banking and Water. She serves as Vice Chair of the Center for the Economic and Environmental Partnership.